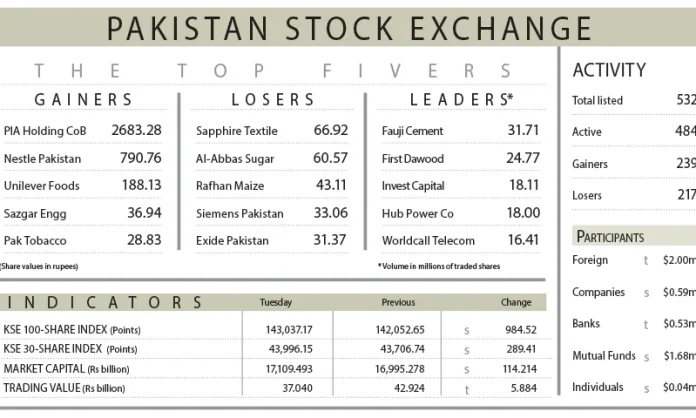

The Pakistan Stock Exchange (PSX) extended its record-setting rally for a third consecutive session on Tuesday, with investors continuing to cherry-pick stocks, pushing the benchmark KSE-100 index past the 143,000-point mark.

According to Topline Securities Ltd, the bullish momentum continued from the previous two sessions, with the KSE-100 index reaching an intraday high of 1,229 points before closing at 143,037, a gain of 985 points or 0.69 per cent. Investor confidence remained strong, driven by robust local and foreign inflows and broad-based rallies across various sectors.

A key factor behind the market’s upbeat performance was the release of Pakistan’s fiscal data for FY25. The government reported a 9-year low fiscal deficit of 5.38pc, with revenue growth of 36pc year-on-year (YoY), outpacing an 18pc rise in expenditures.

This performance surpassed both the government’s and the International Monetary Fund’s (IMF) forecast of a 5.6pc GDP deficit. The positive fiscal data, along with market optimism over fiscal discipline and macroeconomic stability, is expected to fuel further market momentum in the coming sessions.

Major stocks driving the market higher included Fauji Fertiliser, United Bank, MCB Bank, Hub Power, and Engro Fertiliser, which collectively contributed 679 points to the index. However, Pakistan Petroleum, Bank Al-Habib, and Habib Bank saw declines, trimming 142 points from the overall index.

Ahsan Mehanti of Arif Habib Corporation commented that the PSX reached a new all-time high during the earnings season, bolstered by a strong earnings outlook. He also pointed to the government’s approval to resume subsidies for the fully-funded remittances scheme, as well as speculations regarding steps to resolve the power sector’s circular debt, as catalysts for the bullish close.

Ali Najib, Deputy Head of Trading at Arif Habib Ltd, echoed these sentiments. He highlighted the market’s optimism, driven by strong earnings projections and the better-than-expected fiscal performance.

Meanwhile, the cement sector continued its strong performance, with dispatches rising 30.1pc YoY in July, driven by both domestic and export demand. Analysts anticipate that increased construction activity and competitive pricing will sustain growth and high utilisation levels across the sector.

Despite the bullish trend, market activity showed signs of weakening, with trading volume falling by 17.5pc to 549.71 million shares.

The traded value also dipped by 13.7pc to Rs37.04bn. Fauji Cement led the volume chart, with 31.71 million shares exchanged.

Looking ahead, analysts expect the positive earnings season and consistent good news flows to keep bears at bay. However, they caution that the 140,000-point mark could serve as a strong support level in the event of a market correction.

Read also: Bawany Air Products receives corrigendum to acquisition PAI