Shrugging off political noise, bulls further tightened their grip on the Pakistan Stock Exchange (PSX) on Wednesday, propelling the KSE-100 index past the psychological barrier of 145,000 points for the first time, as investors aggressively pursued value-hunting across the board on the back of strong economic fundamentals.

In a statement issued by the Prime Minister’s Office on Wednesday, Prime Minister Shehbaz Sharif said the bullish trend in the stock market reflected investor confidence in the government’s economic policies.

“The recent upward momentum in the stock exchange indicates growing trust in the government’s direction and commitment to economic stability,” he added.

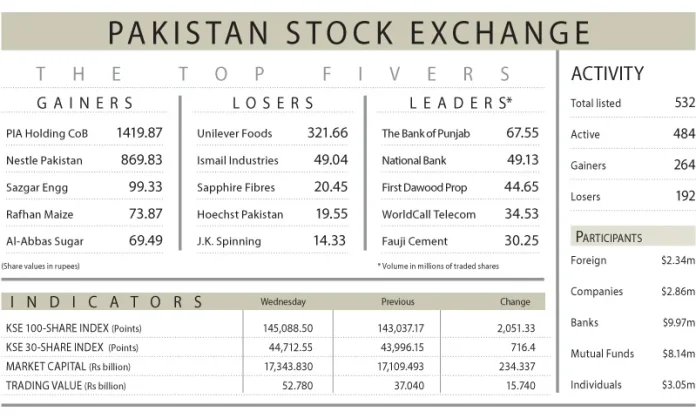

According to Topline Securities Ltd, the benchmark index extended its bullish run for a fourth consecutive session, hitting an intraday high of 2,150 points before closing at 145,088 — a robust gain of 2,051 points or 1.43 per cent.

Banking stocks were the standout performers, with Habib Bank Ltd (HBL), National Bank of Pakistan (NBP), Meezan Bank, and United Bank Ltd (UBL) collectively contributing 1,017 points to the index. HBL and NBP hit their upper circuits during intraday trade, though mild profit-taking toward the close slightly trimmed gains.

Market capitalisation trends reflected sustained investor confidence. Two years ago, only three companies — Oil and Gas Development Company (OGDC), Nestle, and Colgate-Palmolive — had a market capitalisation above $1bn.

A year ago, four more joined this group: Meezan Bank, Mari Petroleum, UBL, and Pakistan Petroleum. As of now, the list has grown to 15 companies, highlighting the market’s strong performance. OGDC, Nestle, and Colgate-Palmolive have consistently remained on this list over the past three years.

Ahsan Mehanti of Arif Habib Corporation attributed the record-breaking rally to a firm economic outlook, supported by a strengthening rupee, government subsidies for fully funded remittance schemes, rising global crude oil prices, and a renewed commitment to resolve circular debt in the power sector. Easing industrial tariffs and financial restructuring also played a catalytic role in the bullish close.

Ali Najib, Deputy Head of Trading at Arif Habib Ltd, said the rally extended for a sixth consecutive day, with the KSE-100 index breaching both the 144,000 and 145,000 levels within a single session.

The banking sector once again led the momentum as investors increased exposure amid strong quarterly earnings and attractive dividend announcements. MCB Bank announced its second-quarter CY25 results during the day, reporting an earnings per share (EPS) of Rs12.31 and a dividend of Rs9 per share, largely in line with market expectations.

Additionally, Fauji Fertiliser Company (FFC), in a corporate briefing, announced its intention to achieve Shariah-compliant status by end-CY25.