In a sweeping legislative update, the government has ushered in a new era of taxation through the Finance Act 2025, reshaping rules to tighten compliance, expand the formal economy, and encourage digital transactions.

The Federal Board of Revenue’s latest circular mentioned detailed insights into these reforms, which affect salaried individuals, pensioners,...

The National Electric Power Regulatory Authority (NEPRA) has indicated a possible reduction of Rs1.80 per unit in electricity prices under the Quarterly Tariff Adjustment (QTA) for the quarter ending June 2025.

The proposed relief, if approved, could provide consumers across Pakistan with financial relief amounting to Rs53.393 billion.

The proposal was...

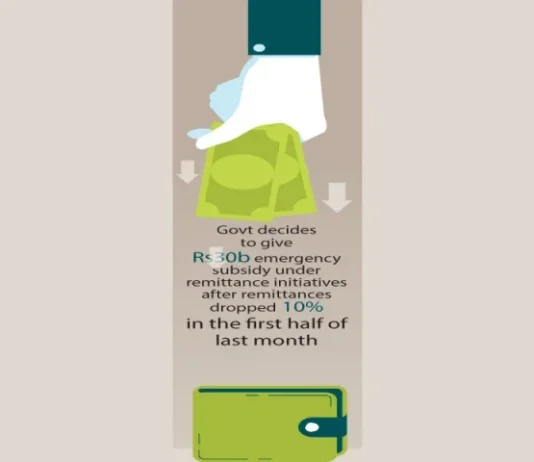

The federal government has decided to initially provide a Rs30 billion supplementary grant to resume subsidies for foreign remittances, indicating a lack of proper consultation among stakeholders before the finance ministry dropped the subsidies from the budget in June.

Government sources told The Express Tribune that the finance ministry has...

The Federal Board of Revenue (FBR) will notify a date for imposing restrictions on the economic transactions of “ineligible persons”, who would fail to declare sources of income/investments in their wealth statements.

Explaining the Finance Act 2025, the FBR has issued income tax circular (1 of 2025) here on Monday.

According...

The federal Board of Revenue (FBR) will disallow 50 percent business expenditure in cases where a person makes a sale of Rs 200,000 or above on a single invoice and payment is not received through banking channel or digital means.

According to an income tax circular issued by the FBR...

The Federal Board of Revenue (FBR) has relaxed some major enforcement provisions of the Finance Act 2025 including provisions of arrest in tax fraud cases and cash deposits in the bank account of the seller would now be considered through banking channels.

The FBR has also announced that the withholding...

Confirming widespread overbilling and subsequent punitive action against relevant electricity officials in Lahore following a probe ordered by Prime Minister Shehbaz Sharif, the Power Division on Monday said the federal government cannot abolish electricity duty — as announced by the power minister — without the consent of the provincial...

Amid mounting pressure from the business community over sweeping powers granted to tax officials under Sections 37A and 37B of the Sales Tax Act, the Federal Board of Revenue (FBR) has introduced a procedural framework to regulate arrests in tax fraud cases, providing safeguards to prevent misuse.

The move follows a nationwide strike by...

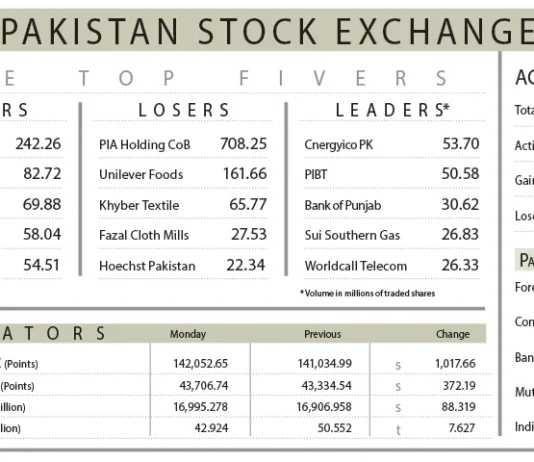

The Pakistan Stock Exchange (PSX) reached an unprecedented milestone on Monday, with the benchmark KSE-100 index breaching the 142,000 mark for the first time.

The rally was driven by optimism surrounding strong corporate earnings announcements expected this week, alongside a landmark tariff deal with the United States and growing expectations...

HBL today declared a record consolidated profit before tax of Rs 75.3 billion for the half year ended June 30, 2025, 30% higher than in the same period last year.

The profit after tax increased 19% to Rs 34.4 billion despite a 4% higher tax rate further burdening banks. EPS...