The Federal Board of Revenue (FBR) has extended the date of submission of Sales Tax and Federal Excise Return for the tax period of June, 2025 up to August 4, 2025. This is subject to the condition that due sales tax liability has been deposited within due date.

In this...

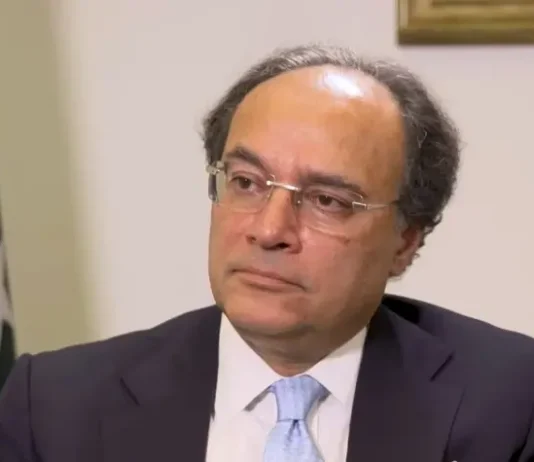

Federal Board of Revenue (FBR) Member, Inland Revenue, (Operations) Dr Hamid Ateeq Sarwar said Thursday that International Monetary Fund (IMF) has linked abolition of four percent “further sales tax” on supplies to un-registered persons with sales tax registration of 50,000 persons.

Explaining the rationale of retaining four percent additional sales...

Minister of State for Finance, Bilal Azhar Kayani Thursday said the government will not amend Finance Act 2025 to further change definition of tax fraud or procedure for arrest, but the Federal Board of Revenue (FBR) will issue sales tax explanatory circular to address all concerns of the business...

Coordinator to the Federal Tax Ombudsman Saif Ur Rehman on Sunday expressed serious concern over the rising trend of over-invoicing on imports, warning that the practice is causing billions of rupees in losses to the national exchequer and poses a significant threat to the country’s economic stability. Talking to...

As the business community prepares for a countrywide shutter-down strike on July 19 in protest against Sections 37A and 37B of the Sales Tax Act — which grant expanded powers to tax officials — Finance Minister Muhammad Aurangzeb has invited trade and industry representatives to Islamabad for dialogue on...

Pakistan has long awaited this moment of certainty, optimism, and stability. The broader KSE-100 index of the Pakistan Stock Exchange (PSX) has surged to historical levels, crossing 134,000, and remains an attractive proposition.

Just a few years ago, many had written Pakistan off, fearing imminent default, while even the most...

KTC has raised concerns over the recent decline in its cigarette sales, attributing it to a sharp rise in the smuggling of international cigarette brands in Pakistan. This surge in illicit trade poses a significant threat to the company's operations and the local market.

The tobacco manufacturing entity emphasized the...

Today, Prime Minister Shehbaz Sharif presented awards to 65 leading exporters and compliant taxpayers in a ceremony held at the PM Office. Among the recipients, Mr. Tariq Rafi, the Chairman of Siddiqsons Group, was recognized as the 4th highest taxpayer by the Prime Minister.

Established in 1959, Siddiqsons Group has...

In a notable development, the International Monetary Fund (IMF) has urged Pakistan's Federal Board of Revenue (FBR) to discontinue the practice of granting preferential treatment to specific sectors and enforce uniform taxation policies across the board. This call for equitable taxation aligns with the IMF's broader objectives of promoting...

The International Monetary Fund (IMF) is advocating for the imposition of sales tax on e-commerce transactions, including those conducted through Facebook and other digital platforms. This push from the IMF underscores the organization's emphasis on broadening the tax base and ensuring equitable taxation in the digital economy.

The IMF's call...